By Dr. Chris Pyke, GRESB

GRESB is  a platform to assess, score, and benchmark the sustainability performance of property companies and funds around the world. In 2015, GRESB covered a broad cross-section of the investor-owned real estate universe, including 707 companies and funds with an aggregate asset value of USD 2.3 trillion. For context, GRESB covers 55% of the value of North American listed companies included in the regional FTSE EPRA/NAREIT index – an aggregate value of over $520 billion. GRESB’s goal is to provide institutional investors with systematic information about the environmental, social, and governance (ESG) performance of real estate companies and funds. GRESB is not a certification; rather, GRESB’s ESG data provides actionable transparency for investors.

a platform to assess, score, and benchmark the sustainability performance of property companies and funds around the world. In 2015, GRESB covered a broad cross-section of the investor-owned real estate universe, including 707 companies and funds with an aggregate asset value of USD 2.3 trillion. For context, GRESB covers 55% of the value of North American listed companies included in the regional FTSE EPRA/NAREIT index – an aggregate value of over $520 billion. GRESB’s goal is to provide institutional investors with systematic information about the environmental, social, and governance (ESG) performance of real estate companies and funds. GRESB is not a certification; rather, GRESB’s ESG data provides actionable transparency for investors.

GRESB asks companies and funds about a cross-section of important aspects of ESG management and operational performance. GRESB puts a priority on energy and greenhouse gas emissions with a set of questions on policies, technical building assessments, data management, and performance monitoring. This includes specific questions related to zero net energy buildings. Progress toward ZNE buildings is one dimension of preparation for emerging regulatory regimes and increasingly competitive markets. For example, new buildings occupied or owned by public authorities after 2019 will need to be “nearly zero-energy buildings.” Further, by 2021, all new buildings in the EU will need to meet the same standard.

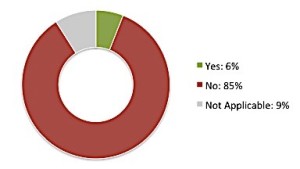

In 2015, 6% of GRESB participants with new construction activities reported that they had net-zero energy policies for development projects. These 17 companies and funds come from around the world, including Germany, Switzerland, the United States, Australia, and Japan. They report a wide-range of development, including residential, commercial, and industrial properties.

In 2015, 6% of GRESB participants with new construction activities reported that they had net-zero energy policies for development projects. These 17 companies and funds come from around the world, including Germany, Switzerland, the United States, Australia, and Japan. They report a wide-range of development, including residential, commercial, and industrial properties.

This feels like an important milestone. These are investor-owned companies and funds producing competitive, market-rate products; not bleeding edge, public or non-profit project owners. The new results provide one data point suggesting that efforts to accelerate and broaden engagement with zero net energy buildings are working.

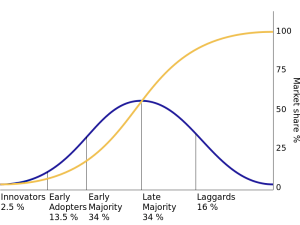

Based on theories of market adoption, we may be reaching the end of the beginning with respect to engagement with ZNE among mainstream property companies. Everett Roger’s now classic book Diffusion of Innovations popularized the study of the spread of new ideas, including suggesting the widely used milestones of 2.5% for innovators and 13.5% early adopters. This year’s 6% number suggests that the ZNE concept has comfortably moved beyond the innovator phase in the GRESB universe, and it is making progress among early adopters. This feels about right.

If this is true, then this is a critical moment to continue to push and prepare for a potential surge in demand that accompanies the transition from early adopters into early majority. This is another 25% of the market and a more than a four fold increase in absolute market activity.

If this is true, then this is a critical moment to continue to push and prepare for a potential surge in demand that accompanies the transition from early adopters into early majority. This is another 25% of the market and a more than a four fold increase in absolute market activity.

Today, ZNE commitments remain rare in the GRESB universe. However, they are increasing, and they may be reaching a tipping point. In the year ahead, we will study these trends in more detail and watch carefully for signs of acceleration and opportunities for constructive interventions that will accelerate ZNE adoption among organizations that report to GRESB. We are looking forward to learning more when the 2016 GRESB Real Estate Assessment opens for participation on April 1st.

Dr. Chris Pyke is COO for GRESB